November 2021 E-News: Chinks in China’s Armor Create Opportunities for U.S. Industrial Recovery |

China is facing a number of domestic issues including: labor shortage, shipping and electricity. The U.S./China relationship is facing additional issues: Taiwan and the possibility of decoupling. While these issues will continue to cause problems for U.S./global supply chains, they are also propelling a long overdue push in the U.S. toward greater self-sufficiency.

|

Background

|

|

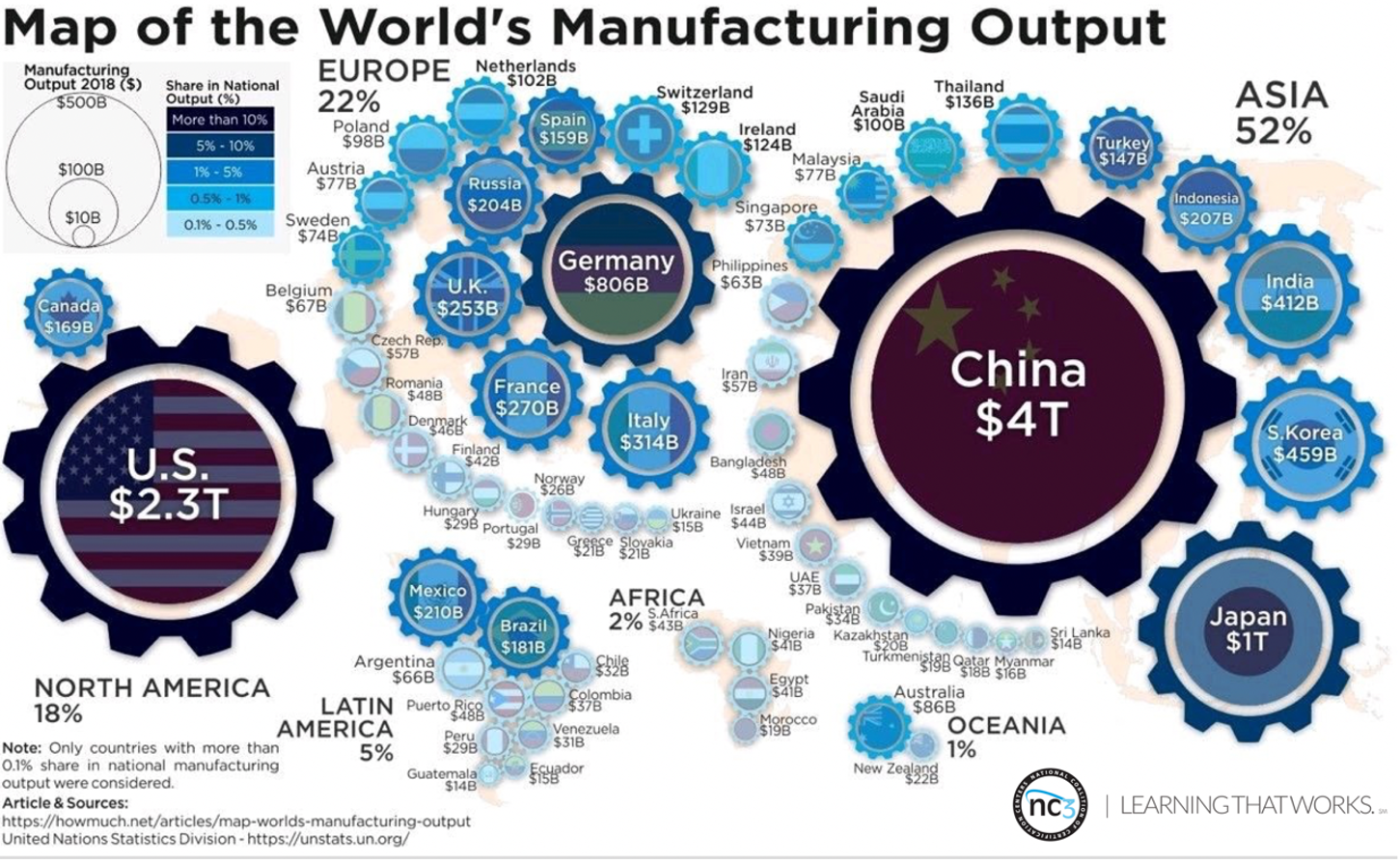

The relative size of U.S. and Chinese manufacturing is actually much worse than the 1.6X shown in the chart. Manufacturing is measured in value. U.S. prices are, on average, 40% higher than China’s. Therefore, China’s manufacturing is about $5.6T which, if measured at U.S. price levels, is about 2.4X the U.S level. The difference in output is troubling, giving China huge advantages with supplier countries, in military material and the ability to stop shipping essential materials and products to the U.S.

The U.S. trade deficit continues to rise. Our deficit with China is up 10% from 2020, projected to reach $340 billion, which represents about 2.5 million manufacturing jobs. When we balance the trade deficit, China’s output will only be about 1.7X U.S. Below is a summary of China trends, followed by some reasons to expect a closing of the trade and output gaps. |

Problems in China

Daily Memo: … Financial Pressure in China “Factory gate prices in China are rising at a record pace as a result of the myriad inflationary forces hitting economies across the globe, including increasing wages and soaring energy costs. China’s official producer price index for the month of September showed a 10.7 percent increase over a year ago, following a 9.5 percent jump in August. This is the fastest increase since the mid-1990s.” October’s PPI rose to 13.5% year over year. The CPI was up only 1.5%. China is shifting the cost increases to exports while protecting its consumers. China Macro Economy

China’s Manufacturing Activity Contracts for Second Straight Month Manufacturing sector weighed down by raw material costs, a power crisis and a slowdown in the property sector.

Why does Evergrande matter? “The Evergrande crisis is not the cause of anything. It is simply one of the most recent of a series of debt-related crises beginning with that of Baoshang Bank in May 2019. These…reflect the unsustainable underlying debt dynamics that have characterized the Chinese economy for at least a decade."

What Does Evergrande Meltdown Mean for China? “China’s official debt-to-GDP ratio has soared by nearly 45 percentage points in the past five years, leaving it with among the highest debt ratios for any developing country in history.” The property sector is one of the main engines of economic activity for the Chinese economy, accounting for as much as 25 percent of the country’s GDP (considerably higher than is typical in other countries).” “Between one-fifth and one-quarter of the total housing stock, especially in more desirable cities—owned by speculative buyers who have no interest in either moving in or renting out." China Urges Evergrande’s Hui to Pay Debt With His Own Wealth. Such severe actions may be justified but will chill investment in China. U.S. Signals No Thaw in Trade Relations With China “…United States Trade Representative Katherine Tai...“offered [the Administration’s] strongest signal yet that the United States’ combative economic approach toward China would continue, with senior administration officials saying that President Biden would not immediately lift tariffs on Chinese goods and that he would hold Beijing accountable for trade commitments agreed to during the Trump administration.” |

Shadow Inflation: Shipping costs are up way more than you think Latest data:

|

Summary: China has huge momentum, assets and production capability. The issues so far are not enough to cripple China but are much more severe than in the past. There is some risk that the Communist Party will divert its people from increasing problems by focusing on a foreign threat. |

Opportunities for the U.S.

Logistics managers plan to pivot towards regional/domestic supply chains “The report highlights several ways the industry plans to change to limit future disruptions: advancements in technology, reshoring of production, growth of the supply chain as-a-service business model.” The Onshoring Project (TOP), a Consortium to Drive Thought Leadership on Strategic Supply Management Practices In the wake of ongoing global supply chain disruptions, a consortium of North American innovators, practitioners, and supply chain experts from across the manufacturing industry have launched a new endeavor with the express intent to reverse the five-decade trend toward offshoring. TOP’s success will help the U.S. achieve balance with China. 2021 State of the U.S. eCommerce Consumer Survey Shopping "Made in America" and sustainability top of mind for consumers of all generations:

What does the next manufacturing workforce think about industry? Another research study of 1,000 U.S. respondents aged 18-24 was conducted in June by Parsable, and found that the COVID-19 pandemic has had an impact on Gen Z’s perception of manufacturing. For example, more than half of respondents (54%) said they had not considered frontline manufacturing as a potential career before the pandemic; of those, 24% are now open to exploring it. |

Reshoring Initiative Gives and Receives Awards |

|

|

Receiving the award in this picture, is Matt Thavis, Director of Business Development, Acme Alliance, Mauri Mendes, President, Acme Alliance-Lovejoy Industries, JR Kinnett, General Manager, Acme Alliance from Harry Moser, Founder & President, Reshoring Initiative. Photo by Bruce Morey/SME. |

Harry Moser Inducted to Association for Manufacturing Excellence (AME) Hall of Fame The AME Hall of Fame recognizes industry thought leaders and influencers who support the values, principles and practices found within leading enterprise excellence organizations. The nomination criteria include the significance of an individual's contributions to the growth of enterprise excellence within the lean, continuous improvement community. Local sourcing is a lean practice. |

Comments

Post a Comment